Karachi: The Pakistani rupee experienced mixed movement against major international currencies in the open market, as economic activity, overseas remittances, and import-related demand continued shaping exchange trends across the country.

The US Dollar, which remained the most closely watched currency, was being bought at Rs 281.10 and sold at Rs 283.20. Market observers noted that the dollar’s position reflected Pakistan’s ongoing trade requirements and foreign payment obligations, while exporters and importers closely followed intraday movements.

Meanwhile, the Saudi Riyal, an important currency due to Pakistan’s strong labor ties with the Kingdom, was recorded at Rs 74.80 for buying and Rs 75.35 for selling. Millions of Pakistani workers employed in Saudi Arabia continued sending remittances back home, making the riyal’s stability vital for household incomes across Pakistan.

The UAE Dirham also held significance, especially for families relying on earnings from the Gulf region. The dirham was traded at Rs 76.60 on the buying side and Rs 77.40 on the selling side. Remittance inflows from the UAE were seen supporting foreign exchange liquidity during the period.

Another Gulf-linked currency, the Omani Riyal, stood at Rs 728.10 for buying and Rs 738.10 for selling. Pakistanis working in Oman remained an important source of steady remittances, particularly for households in Punjab and Khyber Pakhtunkhwa.

From the Western economies, the British Pound Sterling was observed at Rs 376.10 for buying and Rs 379.60 for selling. The pound’s movement was being monitored by students, families, and businesses with financial exposure to the United Kingdom.

Similarly, the Canadian Dollar was recorded at Rs 202.00 on the buying end and Rs 205.00 on the selling end. Canada’s growing Pakistani diaspora continued contributing to remittance flows, especially through family support and educational expenses.

Overall, the rupee’s performance during the session reflected a balance between external payment pressures and remittance-driven support. Analysts said currency movements remained sensitive to global economic signals, energy import costs, and Pakistan’s foreign inflows.

Pakistani Rupee Performance Reviewed as Major Currencies Recorded Mixed Movement in Open Market

More News

USD to PKR Open Market Update

December 23, 2025

Silver Rate in Pakistan Today

December 23, 2025

Gold Rate in Pakistan Today

December 23, 2025

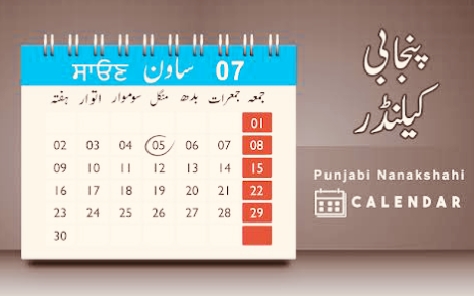

Punjabi Date Today

December 23, 2025

Islamic Date in Pakistan Today

December 23, 2025

Open Market Exchange Rates in Pakistan Today

December 22, 2025

Interbank Currency Exchange Rate Pakistan

December 22, 2025