Karachi: The Pakistan Stock Exchange closed Thursday’s trading session on a negative note as the KSE-100 Index suffered broad-based losses amid heavy institutional selling. The benchmark index shed nearly two percent, reflecting weak sentiment across major sectors, particularly banking, fertilizer, and oil exploration stocks.

Trading began on a steady note, with the index opening at 188,023.60 points. The market briefly climbed to an intraday high of 188,036.31 points as investors tested buying positions. However, profit-taking soon set in, and sellers gradually took control, reversing the early gains.

As the session progressed, pressure mounted on blue-chip stocks, pushing the index sharply downward. The benchmark fell to an intraday low of 183,547.29 points before recovering slightly toward the end. Nevertheless, it closed at 184,129.58 points, marking a loss of 3,702.50 points.

Market observers said that uncertainty over economic indicators and cautious investor behavior contributed to the decline. Many traders opted to secure profits from previous rallies rather than take fresh positions. The day’s trading volume reached 798.69 million shares, reflecting active market participation.

On the positive side, several stocks helped cushion the fall. K-Electric (KEL) topped the gainers’ list with a 58.96-point contribution. Sazgar Engineering (SAZEW) added 54.33 points, while PIOC, JVDC, and TRG also recorded modest gains. These stocks attracted selective buying interest from investors seeking opportunities in mid-cap and industrial sectors.

However, the market was weighed down by significant draggers. National Bank (NBP) emerged as the biggest negative contributor, followed by Fauji Fertilizer Company (FFC) and Pakistan Petroleum Limited (PPL). Banking giants United Bank (UBL) and MCB Bank (MEBL) also added to the pressure, collectively accounting for a substantial portion of the index’s decline.

Despite the correction, the broader outlook remains encouraging. The KSE-100 continues to show strong fiscal year-to-date growth of 46.57 percent, while calendar year gains stand at 5.79 percent. Analysts believe that temporary corrections provide opportunities for long-term investors to enter quality stocks at attractive valuations.

They recommend maintaining diversified portfolios and avoiding panic selling during volatile sessions, emphasizing that market fundamentals remain intact.

PSX Ends Lower After Volatile Session, KSE-100 Down 1.97% on Heavy Institutional Selling

More News

Interbank Currency Exchange Rate in Pakistan Today

February 9, 2026

Open Market Exchange Rates in Pakistan Today

February 9, 2026

Gold Rate in Pakistan Today

February 9, 2026

Silver Rate in Pakistan Today

February 9, 2026

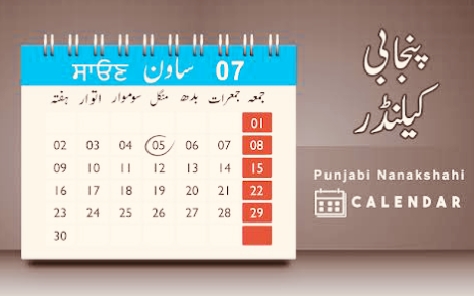

Punjabi Date Today

February 9, 2026