Karachi: The Pakistan Stock Exchange (PSX) continued to face selling pressure on Monday as the KMI-30 Index closed sharply lower, weighed down by heavy losses in energy, banking and cement stocks. Despite a positive start to the session, the market failed to sustain early momentum and slipped steadily throughout the day, reflecting cautious investor sentiment and profit-taking in major heavyweight counters.

According to official market data, the KMI-30 index opened at 261,474.81 points and quickly climbed to an intraday high of 262,188.84 points during early trading hours. However, the gains proved temporary as sellers dominated the floor soon after. The index reversed course and slid to an intraday low of 254,361.82 points, showing heightened volatility before recovering slightly toward the close.

By the end of the session, the benchmark settled at 256,499.31 points, registering a decline of 3,408.58 points or 1.31 percent. Analysts described the day as correction-driven, with investors booking profits following recent rallies and trimming exposure in high-capitalization stocks.

Trading activity remained moderate, with index constituent volume recorded at 111.48 million shares. Market watchers noted that although volumes were not exceptionally high, the consistent selling pressure in blue-chip stocks kept the index under stress for most of the day.

Among the stocks providing support, Sazgar Engineering (SAZEW) stood out as the top performer, contributing 256.31 points to the index. Ghani Glass (GHNI) followed with 42.04 points, while Pak Elektron (PAEL), GlaxoSmithKline (GLAXO), and Sui Northern Gas Pipelines (SNGP) also posted modest gains. These counters attracted selective buying interest from investors seeking defensive or growth-oriented opportunities.

However, gains were overshadowed by major draggers. Oil & Gas Development Company (OGDC) led the decline, wiping out 702.77 points from the index. MCB Bank (MEBL) shed 515.95 points, while Pakistan Petroleum Limited (PPL), Lucky Cement (LUCK), and Hub Power Company (HUBC) further deepened losses. The combined negative contribution of these stocks significantly outweighed the positive impact from gainers.

Despite the day’s decline, broader market performance remains encouraging. The KMI-30 still shows fiscal year-to-date growth of 38.73 percent, while calendar year-to-date gains stand at 3.20 percent, indicating overall resilience.

Experts believe that short-term volatility may persist but maintain that strong fundamentals and improving macroeconomic indicators could support a recovery. Investors are advised to remain cautious and focus on long-term strategies rather than reacting to daily fluctuations.

KMI-30 Drops Over 3,400 Points as Energy and Banking Stocks Drag PSX Lower

More News

Interbank Currency Exchange Rate in Pakistan Today

February 9, 2026

Open Market Exchange Rates in Pakistan Today

February 9, 2026

Gold Rate in Pakistan Today

February 9, 2026

Silver Rate in Pakistan Today

February 9, 2026

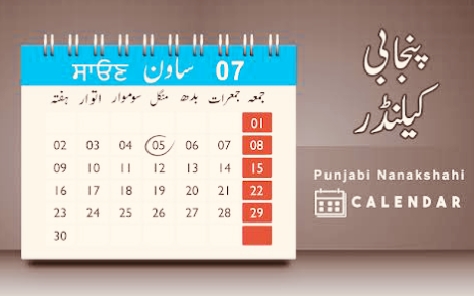

Punjabi Date Today

February 9, 2026