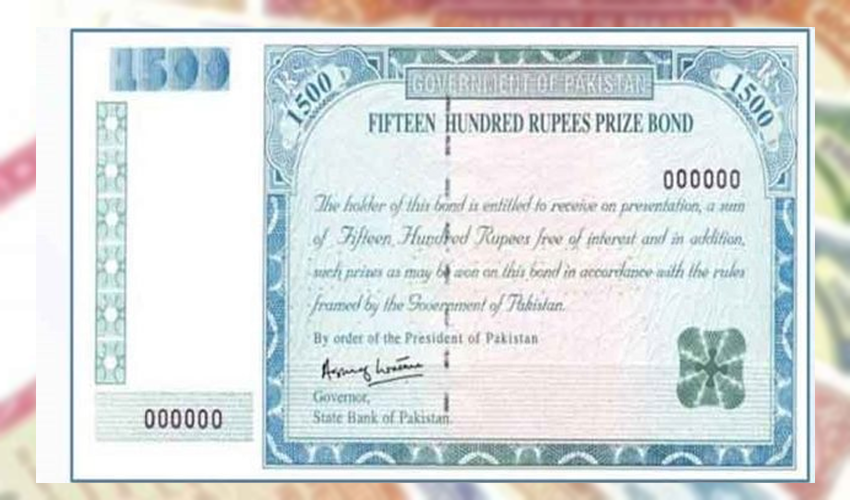

ISLAMABAD: Pakistan’s government has announced an increase in the withholding tax rates on earnings from prize bonds and profits generated from loans. These updated rates will apply to both individuals registered as tax filers and those who are not.

Under the new notification issued by authorities, tax filers who win prize bonds will now see a 15 percent withholding tax deducted from their winnings. In contrast, non-filers will face a considerably higher rate of 30 percent on their prize bond gains.

The revised tax structure also affects profits made from loans. Tax filers will now incur a 15 percent withholding tax on such profits, while non-filers will similarly be taxed at 30 percent on their loan profits.

This measure is part of the government’s wider initiative to boost tax collection and expand the tax net. While these increased rates are anticipated to enhance national revenue, financial analysts suggest they could potentially alter investment behaviors related to prize bonds and certain loan-based financial instruments. The new tax rates are effective immediately.