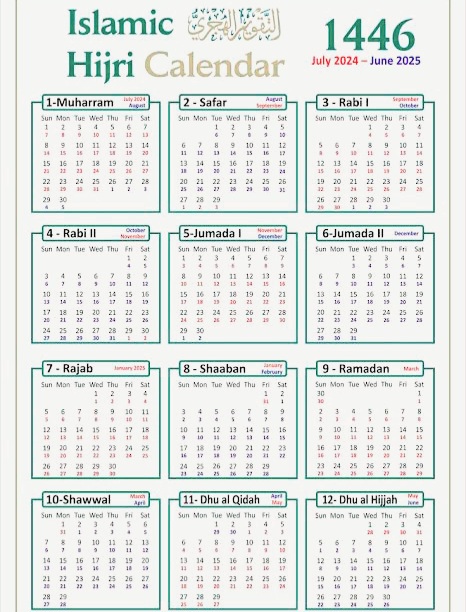

The State Bank of Pakistan (SBP) pulled a surprising rabbit out of the hat on December 16th, 2024, slashing its policy rate by a hefty 200 basis points – that’s a full 2% – down to 13%. This marks the fifth consecutive rate cut, a move that’s got economists buzzing like a beehive. It’s a bold strategy, some might say, especially given the global economic climate.

According to SBP, A confluence of positive economic indicators, primarily a significant drop in inflation. November’s year-on-year inflation clocked in at a surprisingly low 4.9%, right on target with predictions. However, the statement also acknowledged a fascinating divergence – consumer and business inflation expectations painted a somewhat different picture. Think of it like two sides of the same coin, each showing a slightly different image.

Despite this discrepancy, the SBP is clearly betting on the positive trends. The central bank’s press release trumpeted improved growth prospects, painting a rosy picture of the future. This decisive rate cut, they argued, was a carefully calibrated move, a delicate dance between stimulating growth and keeping inflation in check. It’s a high-stakes game, to be sure.

The results so far seem to support their strategy. The current account surplus, for instance, has been consistently positive for three months running, boosting foreign exchange reserves to a healthy $12 billion. This is a significant achievement, bolstering confidence in the Pakistani economy. Lower global commodity prices also played a crucial role, easing pressure on the import bill and, consequently, inflation.

But the SBP isn’t resting on its laurels. They readily admit that the fiscal gap – the persistent difference between tax collections and government targets – remains a significant hurdle. It’s a thorn in their side, a persistent challenge that demands immediate attention.

In essence, the SBP’s move is a calculated risk, a gamble on sustained economic growth while simultaneously safeguarding price and financial stability. It’s a tightrope walk, navigating the treacherous terrain of a volatile global economy. Only time will tell if this audacious strategy pays off. The coming months will be crucial in assessing the long-term effects of this dramatic rate reduction.