Karachi: Bearish sentiment dominated trading at the Pakistan Stock Exchange on February 16, 2026, as the KMI-30 Index recorded a significant loss of 7,017.29 points. The Shariah-compliant index settled at 246,378.79 after opening at 253,230.25, marking a substantial 2.77 percent decline in a single session.

The trading day began on a relatively stable note, with the index briefly touching its high at the opening level. However, consistent selling pressure soon dragged the market lower, pushing it to an intraday low of 245,012.55. Analysts attribute the downturn to profit-taking in heavyweight stocks and cautious investor behavior amid uncertain economic signals.

Index constituent volume reached nearly 123 million shares, reflecting strong market participation despite the downturn. Observers noted that the high volume indicates active repositioning by institutional investors rather than a lack of liquidity.

The biggest drag on the index came from Engro Holdings, which alone contributed a negative 912.49 points. Oil and Gas Development Company followed with a 590.18-point decline, while Meezan Bank Limited shed 549.50 points. Lucky Cement and Fauji Fertilizer Company also weighed heavily on the benchmark, collectively accelerating the downward trajectory.

Sector-wise, energy and fertilizer stocks bore the brunt of selling pressure, aligning with global commodity price fluctuations. Banking stocks also faced headwinds, adding to the index’s losses. The broad-based weakness reflects a cautious approach by investors amid ongoing macroeconomic adjustments.

Despite the sharp daily drop, the KMI-30 remains up 33.26 percent on a fiscal year-to-date basis, underscoring the resilience shown in previous months. However, the calendar year-to-date figure has slipped into negative territory at minus 0.87 percent, highlighting recent volatility.

Market strategists suggest that investors are recalibrating expectations in light of economic data and corporate performance updates. With external factors influencing domestic equities, short-term movements may remain unpredictable.

Experts advise retail investors to focus on fundamentals rather than reacting to daily swings. Long-term prospects for well-capitalized companies remain intact, although near-term volatility could persist.

The latest session reinforces the dynamic nature of equity markets, where heavyweight stocks can significantly influence index movements. Traders and investors alike will be closely watching upcoming sessions for signs of stabilization or continued correction.

Selling Pressure Dominates as KMI-30 Records 2.77% Drop

More News

Dollar, Pound, Riyal & Dirham Rates in Pakistan Today

February 16, 2026

KSE-100 Plunges Over 5,100 Points as Banking Stocks Lead Market Rout

February 16, 2026

Selling Pressure Dominates as KMI-30 Records 2.77% Drop

February 16, 2026

Latest Petrol and Diesel Prices in Pakistan

February 16, 2026

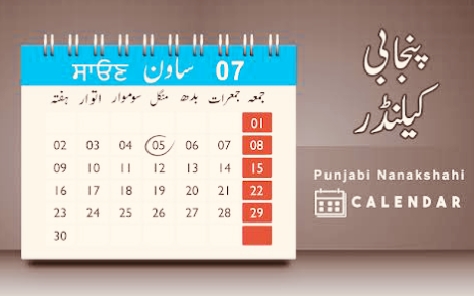

Punjabi Date Today

February 16, 2026

Islamic Date in Pakistan Today

February 16, 2026