Karachi: The Pakistan Stock Exchange witnessed a stormy trading session on Thursday as bears dominated the floor, pushing the KSE-100 index down by more than 6,000 points in a broad sell-off that unsettled investors and erased early gains.

The day began with cautious optimism. The benchmark opened at 188,686 points and briefly surged to an intraday high of 188,923 points. But the upward momentum proved short-lived. Heavy selling soon emerged in fertilizer, banking, and energy stocks, dragging the market into negative territory.

By midday, the decline intensified, with traders rushing to secure profits. The index fell to an intraday low of 181,961 points before closing at 182,338 points — a steep drop of 6,042 points or 3.21 percent.

Despite the slump, market participation remained robust. Over 413 million shares changed hands, highlighting strong activity as investors repositioned their holdings. Analysts described the session as “high volume with defensive sentiment.”

Major blue-chip stocks weighed heavily on the index. Fauji Fertilizer Company led the losses, followed by United Bank Limited, Engro Holdings, OGDC, and Hub Power Company. Their combined negative contribution pulled the benchmark down significantly.

Meanwhile, a handful of stocks such as Mehmood Textile and Packages Limited managed slight gains, offering limited resistance to the falling trend.

Market observers say the downturn appears to be a technical correction rather than a sign of deeper trouble. After months of rallying prices, valuations had risen sharply, encouraging traders to lock in profits.

Looking at the bigger picture, the PSX still shows strength. The KSE-100 has delivered an impressive 45 percent gain in the current fiscal year and remains up nearly 5 percent in 2026 so far. These figures suggest that the broader trend remains intact despite short-term volatility.

Experts believe upcoming economic data, policy announcements, and corporate earnings will determine the market’s next move. If positive signals emerge, buying interest could quickly return.

For now, caution prevails as investors closely monitor developments. Thursday’s sharp fall serves as a reminder that markets can change direction swiftly, but seasoned traders see such corrections as part of the natural market cycle.

PSX Bears Dominate: KSE-100 Records One of Week’s Biggest Drops

More News

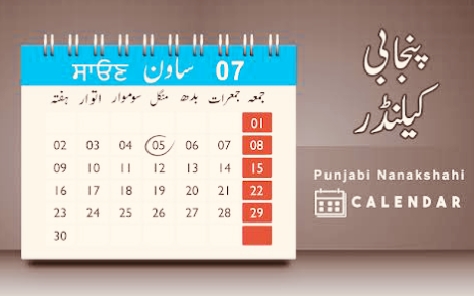

Punjabi Date Today

January 31, 2026

Islamic Date in Pakistan Today

January 31, 2026

KSE-100 Gains 1,836 Points; Engro and Lucky Cement Lead Rally

January 30, 2026

Silver Rate in Today Pakistan

January 30, 2026

Interbank Currency Exchange Rate in Pakistan Today

January 30, 2026

Open Market Exchange Rates in Pakistan Today

January 30, 2026